Recognizing Payday Breakthrough Loans

Payday advance loan fast mobile loans in kenyas are short-term lendings that are usually used to cover unexpected costs or economic emergencies. These loans are often used by people that need fast accessibility to money and do not have the moment to go through a typical funding application process.

Exactly How Payday Advancement Loans Job

Payday advance financings are usually small-dollar financings that are suggested to be repaid on the debtor’s next payday. The borrower generally creates a post-dated check or gives their savings account information to the lending institution, who will certainly then deposit the car loan amount right into their account. On the due day, the loan provider will certainly either pay the check or withdraw the funds from the customer’s account.

These financings are recognized for their high interest rates and costs, which can make them expensive when contrasted to traditional loans. Customers ought to recognize the terms and conditions of the financing prior to accepting them.

- Payday advancement fundings are commonly due in full on the debtor’s following payday.

- Some loan providers offer extensions or rollovers, however these can feature extra fees and fees.

- Consumers ought to only secure a payday advance lending if they are confident they payday loans in durban can repay it in a timely manner.

Benefits of Payday Development Loans

Despite their high expenses, payday advance loans can be useful in certain scenarios. For instance, they give fast access to cash money when required and do not call for a lengthy application process or credit score check. This can be practical for people with bad credit score or those that need money quickly.

Additionally, payday breakthrough car loans can be utilized for a range of functions, such as covering medical expenses, car fixings, or other unexpected expenditures. They can provide a momentary option to economic emergency situations when no other options are readily available.

Downsides of Payday Advance Loans

While payday breakthrough car loans can be handy in some circumstances, they likewise feature a number of drawbacks. The high rates of interest and fees associated with these car loans can make them costly, specifically if the debtor is not able to repay the loan in a timely manner.

- Borrowers can get trapped in a cycle of financial debt if they constantly roll over their loans.

- Some lending institutions have been understood to engage in predatory financing methods, making the most of prone consumers.

- Payday development car loans are not a long-term solution to monetary problems and ought to just be used in emergencies.

Conclusion

Payday breakthrough financings can offer quick accessibility to cash in times of need, yet they feature high expenses and risks. Debtors ought to carefully consider their options and just get a payday breakthrough finance if they are confident they can settle it on schedule. It is very important to read the terms of the loan very carefully and to check out other choices before transforming to payday breakthrough financings.

June 26, 2024 8:28 am | Uncategorized

प्रतिकृयाहरू :

समाचारहरु:

भर्खरै प्रकाशित

निरेम प्रोडक्सन कुवेतको मानवतावादी पहल: दार्चुलाको दुर्गा स्थान माविलाई १ लाख सहयोग

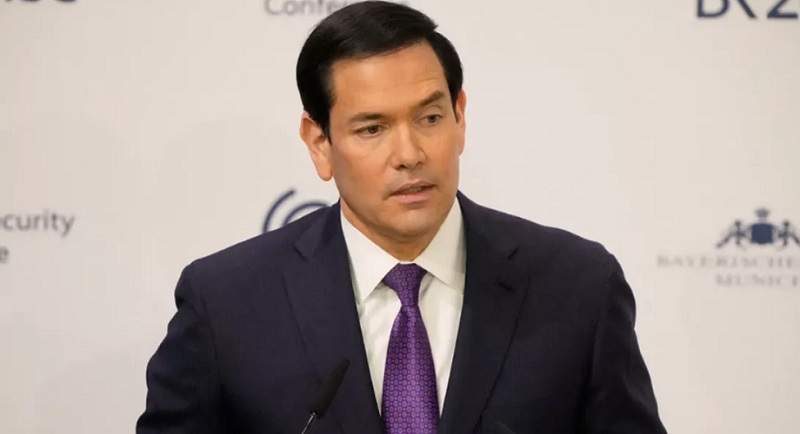

इरानलाई कहिल्यै पनि आणविक हतियार राख्न दिइने छैन : अमेरिकी विदेशमन्त्री

बङ्गलादेशमा बीएनपीलाई दुईतिहाइ बहुमत, विद्यार्थी आन्दोलनबाट स्थापित एनसीपीले जम्मा ५ सिट जित्यो

क्यान्सर पीडित प्रेम कुमारी लिम्बुलाई झापाली समाज कुवैतको आर्थिक

फिलिपिन्सको सर्वाेच्च अदालतको ऐतिहासिक फैसला, समलिङ्गी जोडीले सम्पत्तिको सह–स्वामित्व लिन सक्ने

प्युठानीको सान रुख चिन्न्हमा मतदान डा. गोविन्दराज

गोरखा समाज कुवेतको प्रथम अधिवेशन बाट अध्यक्ष पदमा मदन पनेरू चयन

खोटाङ कुवेत सम्पर्क मञ्च द्वारा दोस्रो सांगीतिक धमका आयोजना हुने