Comprehending Personal Finances: Everything You Need to Know

Personal fundings are a kind of lending that can payday loans online quick loans same day payout be used for a variety of purposes, from combining debt to spending for unexpected costs. They are unsafe fundings, meaning that you do not require to put up any type of security to secure the funding. This makes them a preferred selection for many individuals that require fast access to funds.

Exactly How Personal Lendings Function

When you obtain an individual funding, the lending institution will certainly examine your credit rating and economic circumstance to identify your qualification for the car loan. If you are accepted, you will certainly receive a lump sum of money that you can make use of for any purpose.

Personal financings usually have actually taken care of rate of interest and monthly payments, making it simple to budget for payment. The funding term can vary, yet is typically in between one to seven years.

It is necessary to keep in mind that personal lendings can have greater rates of interest compared to various other kinds of finances, such as mortgages or auto loan, because of the absence of security. However, they can still be a cost-effective method to obtain money if you have an excellent credit score.

- Pros of Personal Lendings:

- Flexible use of funds

- Fixed rates of interest

- Predictable regular monthly payments

In spite of the higher rates of interest, personal financings can be an excellent alternative for those that require fast accessibility to funds and are able to settle the loan in a prompt manner.

Kinds Of Individual Fundings

There are numerous kinds of individual finances offered, each with its very own functions and benefits. Some common types of individual loans consist of:

1. Financial Debt Debt Consolidation Finances: These car loans are made use of to combine numerous debts into one, making it much easier to handle your financial resources.

2. Home Improvement Loans: These loans can be utilized to fund home restoration projects or repair services.

3. Medical Finances: These fundings are made to cover clinical costs, such as surgeries or therapies not covered by insurance coverage.

Just how to Receive an Individual Loan

Receiving a personal lending will depend upon several elements, including your credit score, revenue, and debt-to-income ratio. Lenders will additionally consider your work status and financial background when reviewing your application.

Having an excellent credit history and stable income will certainly raise your possibilities of being accepted for an individual financing. If you have a bad credit report, you might still be able to receive a loan, yet you may be charged a greater interest rate.

Tips for Obtaining the very best Individual Car Loan

When searching for a personal lending, it’s important to compare offers from different lending institutions to find the most effective terms and interest rates. Right here are some pointers to aid you get the most effective individual car loan for your needs:

- Examine your credit rating before using

- Contrast rates of interest and fees from multiple lenders

- Stay clear of looking for multiple lendings at once

- Review the terms and conditions thoroughly before authorizing the financing contract

Final thought

Individual lendings can be a valuable monetary device for those that need fast accessibility to funds for a range of functions. By understanding how individual car loans work and what elements lenders consider when reviewing applications, you can make informed decisions when borrowing cash.

Bear in mind to thoroughly assess the terms of any kind of funding arrangement prior to finalizing, and only obtain what you can manage to repay.

With the right information and careful preparation, personal financings can help you attain your economic objectives and take care of unanticipated expenses properly.

June 27, 2024 3:23 am | Uncategorized

प्रतिकृयाहरू :

समाचारहरु:

भर्खरै प्रकाशित

बङ्गलादेशमा बीएनपीलाई दुईतिहाइ बहुमत, विद्यार्थी आन्दोलनबाट स्थापित एनसीपीले जम्मा ५ सिट जित्यो

क्यान्सर पीडित प्रेम कुमारी लिम्बुलाई झापाली समाज कुवैतको आर्थिक

फिलिपिन्सको सर्वाेच्च अदालतको ऐतिहासिक फैसला, समलिङ्गी जोडीले सम्पत्तिको सह–स्वामित्व लिन सक्ने

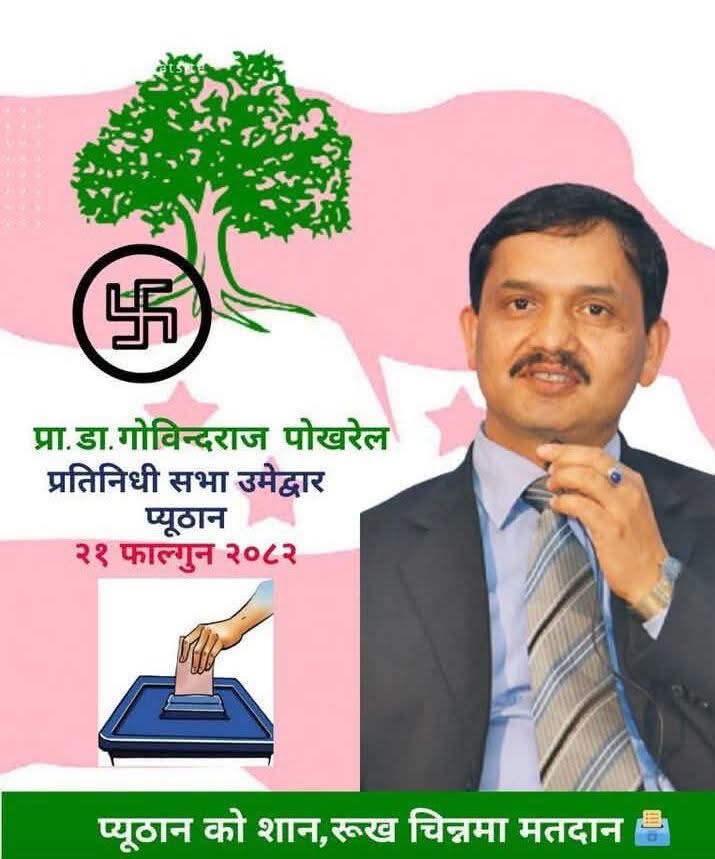

प्युठानीको सान रुख चिन्न्हमा मतदान डा. गोविन्दराज

गोरखा समाज कुवेतको प्रथम अधिवेशन बाट अध्यक्ष पदमा मदन पनेरू चयन

खोटाङ कुवेत सम्पर्क मञ्च द्वारा दोस्रो सांगीतिक धमका आयोजना हुने

दुर्गा प्रसाईं चाल्नाखेलबाट पक्राउ

बैतडीमा जन्ती बस दुर्घटना : ज्यान गुमाएकाका परिवारलाई सुदूरपश्चिम सरकारले एक लाख राहत दिने